Bitcoin Sinks Below $115K As Trump Tariffs Blitz Triggers $705M In Long Liquidations

Bitcoin slid more than 3% to $114,520 early Friday, dragging the broader crypto market with it after US President Donald Trump announced sweeping new trade tariffs on multiple nations.

The sharp drop triggered over $705 million in long position liquidations in the past 24 hours, according to CoinGlass. Ethereum traders bore the brunt of the pain, with $226.37 million in long liquidations, surpassing the $177.72 million shaken out of Bitcoin.

The broader crypto market cap tumbled over 4% to $3.72 trillion, according to CoinMarketCap.

Investor sentiment also took a knock, with the Crypto Fear and Greed Index falling 7 points to a score of 65/100.

Trump Imposes Tariffs On Multiple Trading Partners

The sell-off followed Trump’s signing of an Executive Order that raised tariffs on nations that failed to strike trade agreements with the US by the Aug. 1 deadline.

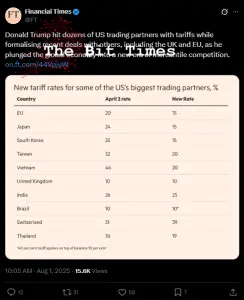

Targets include Canada, Taiwan, Thailand, and Switzerland, while more compliant partners like the EU, UK, and South Korea will see adjusted terms implemented later.

In addition to hiking tariffs on Canada from 25% to 35%, rates for countries that did not reach an agreement with the US before the deadline were also set.

Trump hit South Africa and India with 25% tariff rates and Taiwan with 20%, while a 39% tariff put Switzerland among the most heavily targeted countries.

Related Articles:

- Corporate ETH Holdings Top $10 Billion As Ethereum Marks 10th Birthday

- Strategy Buys $2.46 Billion Bitcoin As BTCS Plans $2 Billion Raise

- NFT Marketplace Rarible Adds Support For Somnia NFTs

Comments

Post a Comment