UNI Price Analysis: ‘Speculation and No Utility,’ Criticizes Traders

UNI, the token of the decentralized exchange protocol Uniswap built on the Ethereum blockchain, has experienced a significant dip in price over the past seven days. According to CoinMarketCap data, UNI is currently down 15.80% to $5.47 from its 7-day all-time high of $6.50.

The decline in UNI’s price comes as the broader crypto market has been on a downward trend recently, with Bitcoin (BTC) and Ethereum (ETH) taking considerable impacts. Despite this dip, Uniswap has maintained a substantial trading volume, with a 24-hour volume above $89 million, representing a 75% increase from the past day.

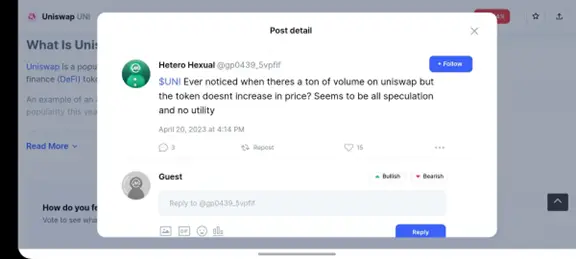

While multiple reports hint that Uniswap remains the most popular decentralized exchange by volume, crypto traders have recently criticized the UNI token for its lack of utility despite its high trading volume. Users have noticed instances where the platform experiences significant trading volume without a corresponding increase in the token’s price. “Seems to be all speculation and no utility,” said a crypto enthusiast on CoinMarketCap’s community forum.

Nonetheless, a Uniswap Twitter account dedicated to tracking its activities reported a rise of 158 new UNI token holders in the past 24 hours, which brings the total number of UNI holders to 432,753. This uptick in holders suggests a sustained interest in the platform and the DeFi space overall.

Notably, Uniswap is a unique automated market maker system that allows users to earn fees by providing liquidity to the platform. It has processed over $100 billion in total volume since its launch in September 2020.

Comments

Post a Comment